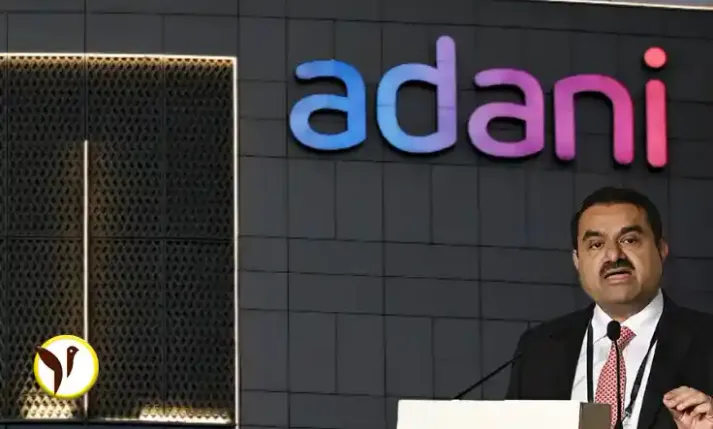

As per the sources cited by the Economic Times private equity groups Bain Capital, Carlyle Group, and Cerberus Capital Management are expected to submit binding bids for NBFC to acquire Adani Capital, the six-year-old shadow bank founded by Gautam Adani. The move comes as Adani aims to come out from non-core businesses to focus on its core operations.

Gaurav Gupta, the head of Adani Capital, has expertise running operations at Helman Brothers and Macquarie. Since 2016, he has utilized his expertise to drive the progress of Adani Capital. While Gupta owns approximately 10% of the business, the promoters maintain a significant stake of around 90%.

With assets under management (AUM) totaling ₹4,000 crores and a book value of ₹800 crores, Adani Capital is seeking a valuation of ₹2,000 crores, approximately 2-2.5 times its book value. The potential investors are also expected to inject growth capital ranging from ₹1,000 crores to ₹1,500 crores.

While most potential buyers are interested in acquiring full ownership of Adani Capital, the promoters will ultimately decide whether to retain a minority stake in the future. The company had previously intended to raise Rs 1,500 crore through an initial public offering (IPO) in 2024, offering a 2 percent stake. However, those plans were disrupted by a critical report released by Hindenburg Research.

Reports also indicated that the Adani Group promoters have been reducing their holdings in various group companies through primary and secondary stake sales. This strategic move aims to build up cash reserves due to the uncertain global investment landscape.

— Harshita Kumar

Also, Read Narayana Murthy reveals three things that are Recruitment Criteria at Infosys